Unveiling the Drama of Market Dynamics: May 14th, 2024

Market Overview

Today marks the expiry of FinNifty, adding an extra layer of excitement to the trading floor. Yesterday, we witnessed a thrilling short covering rally that propelled us from the depths of despair, pausing just as we entered the Call Writers Zone, as foretold in yesterday’s journal. As I pen this blog, GiftNifty is already up by 50 to 60 points, teetering on the edge of the Call writer’s zone, poised to put up a fight. However, amidst this adrenaline-fueled drama, it’s crucial to note that VI has crept up into the danger zone, crossing the ominous threshold of 18 and reaching 20, signaling heightened volatility ahead.

Nifty Outlook

Closing at 22104, with May futures at 22201, Nifty has triumphantly breached the psychological barrier of 22K. At 22000, a formidable Put Open Interest (OI) of 30.69L reinforces support from writers, while a towering Call OI of 52.41L at 22500 looms as resistance for this weekly series. My advice? Don’t rush into the market at the gap up. Instead, wait patiently for it to explore lower levels, seizing the opportunity for a strategic entry point that could potentially yield a 100 points rally. If, by some miracle, the market holds steady above 22150 by 10 a.m. and closes above 22200 in a 15-minute candle, brace yourselves for a possible rally up to 22500. Today, day traders have the tantalizing prospect of a 100+ point adventure on both ends of the spectrum.

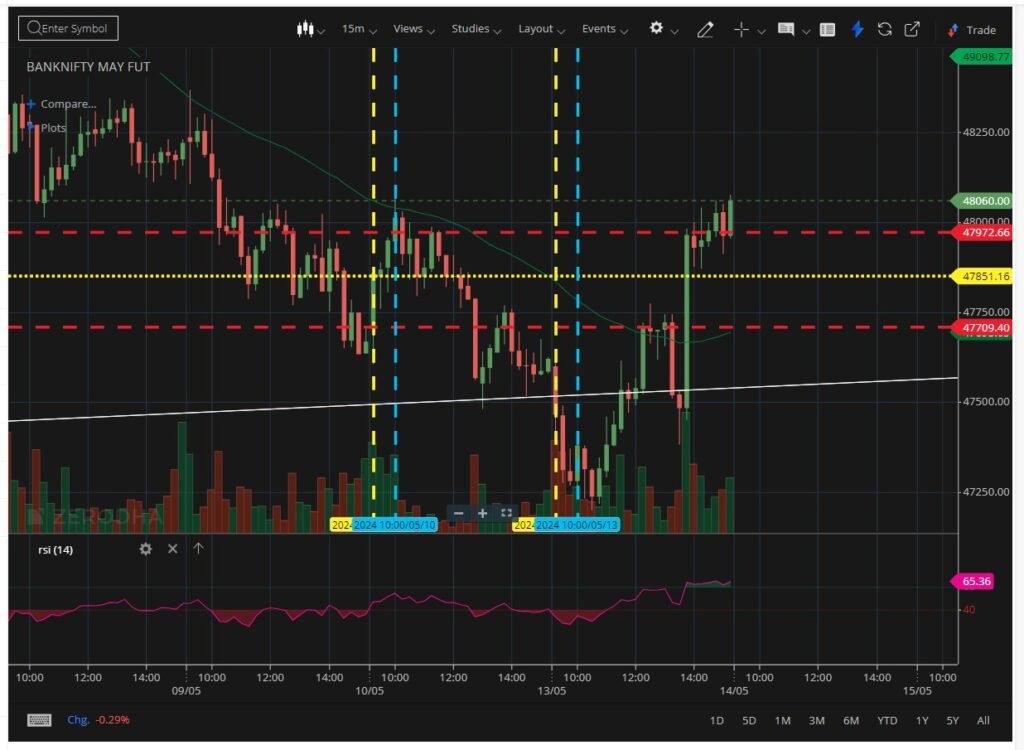

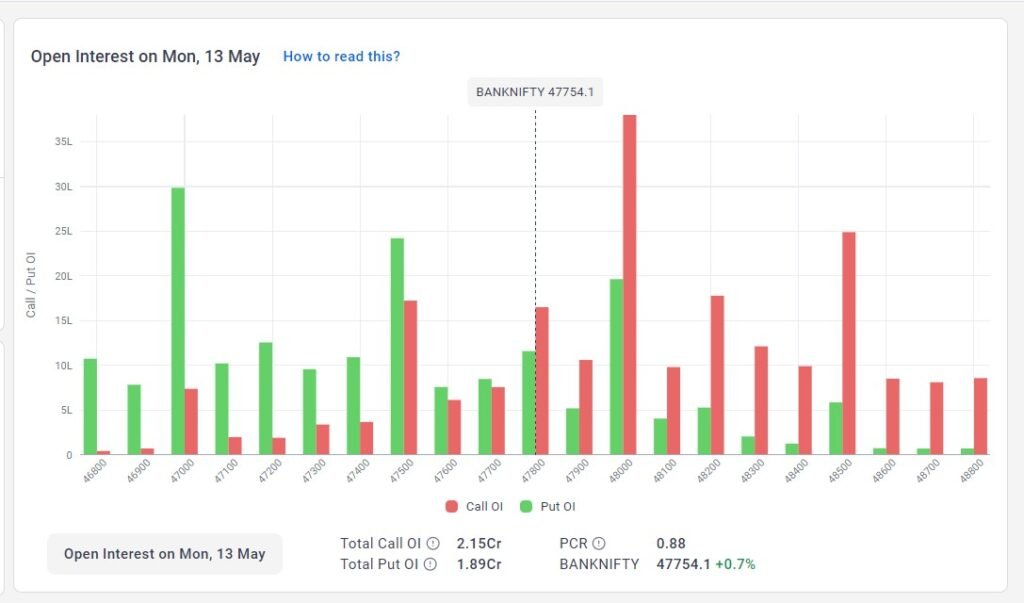

BankNifty Outlook

Yesterday’s staggering rally catapulted BankNifty to close at 47754, with May Futures soaring to 48003, a dazzling surge of 700+ points. As I’ve mentioned before, BankNifty roams within a 2000-point range, oscillating between 47000 and 49000. Today, with the market showing signs of a gap up, we may flirt with the lofty heights of 48500. However, should fate turn against us, brace for a dip to 47500 in the first half, followed by a spirited rally back to 48000, Tomorrow’s BankNifty Expiry adds an extra dash of spice, with hefty Call OI looming at the 48000 strike price, making it highly improbable for the market to close above this mark in this weekly contract. Traders, get ready for a rollercoaster ride, with opportunities abound on both ends, offering a tantalizing bounty of 300 to 500 points.

Today’s trading session promises to be nothing short of a theatrical spectacle, with FinNifty expiry injecting an extra dose of adrenaline into the mix. As Nifty basks in the glow of breaching the 22K milestone, traders tread cautiously, eyeing strategic entry points amidst the tumultuous sea of volatility. Meanwhile, BankNifty dazzles with its dramatic ascent, tempting traders with a whirlwind of opportunities amidst the looming expiry. Strap in tight, dear traders, for today’s market promises thrills, spills, and perhaps a few surprises along the way.

Nifty Options Trading Range 14th May 2024

BankNifty Options Trading Range 14th May 2024

Options Range: 22000 to 22350

Options Range: 47000 to 48000

Leave a Reply

You must be logged in to post a comment.