Market Strength Signals: Nifty and BankNifty Poised for New Highs: May 17th, 2024

Market Overview

Yesterday, Nifty performed as anticipated, delivering a 400-point movement, and BankNifty respected its upper trading zone of 48000. In a volatile session, BankNifty closed at 47977 and futures at 48092. This positive closure above the 20-day moving average is a promising sign for the market. Notably, the markets will be open for trading tomorrow, Saturday, but will remain closed on Monday, providing traders with an extra trading session this week.

Nifty Outlook

Nifty closed above all moving averages at 22403, with May futures at 22452, indicating clear strength in the Indian markets. In the new weekly series, the Put Open Interest (OI) ranges from 22500 to 22000 at 1.25 crore, while the Call OI ranges from 22500 to 22900 at 1.22 crore. Strong support is evident at 22200 with 26.7 lakh and at 22000 with 30.94 lakh. This suggests that the market is poised to breach these levels, and currently sitting above 22400, it might provide an opportunity to position just above 22200. Put writers are likely to defend any up move at 22500, where the highest OI of around 48 lakh between 22400 to 22500 defines a trading range from 22200 to 22500, offering approximately 300 points of movement in both directions.

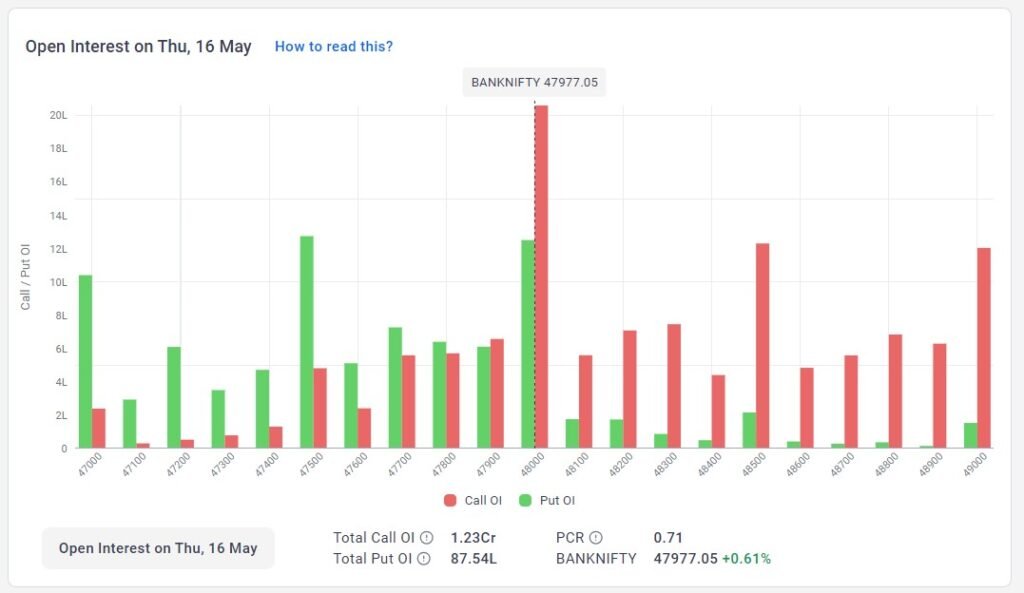

BankNifty Outlook

BankNifty closed at 47977, with May futures at 48092, respecting the Call Writers’ zone of 48000. Opening above 48000 and falling to 47500 provided traders with a full range opportunity, and a reversal in the last hour resulted in a strong close at the upper end of the Call Writers’ zone. This suggests that BankNifty is ready to break out from the 48000 level and move towards the next target of 500 points between 48000 and 48500. With equal open interest on the support side from 48000 to 47500 at 50 lakh and resistance between 48000 to 48500 at 57 lakh, the market is likely to test higher levels today. A stronger HDFC Bank, which showed resilience yesterday, is expected to support BankNifty’s journey towards 48500.

Summary of the Day

Today’s trading session is poised for significant opportunities as both Nifty and BankNifty display signs of strength and resilience. Nifty, closing above all moving averages, is set to potentially breach higher levels with a defined trading range between 22200 and 22500. BankNifty’s strong close at 47977 and the positive momentum from HDFC Bank suggest an upward trajectory towards 48500. Traders should remain vigilant and capitalize on the predicted market movements, especially given the extra trading session on Saturday and the subsequent market closure on Monday.

Nifty Options Trading Range 17th May 2024

BankNifty Options Trading Range 17th May 2024

Options Range: 22200 to 22550

Options Range: 48000 to 48500

Leave a Reply

You must be logged in to post a comment.