Bulls or Bears: Who Will Win Today? : May 16th, 2024

Market Overview

Today is Thursday, marking the expiry day for Nifty. Yesterday, we saw a range-bound trading session between 22200 and 22300, resulting in a flat day for Nifty. As anticipated, BankNifty provided the predicted trading range of 400 to 500 points, first moving up to 48200 and then dropping to 47600. At the time of writing this journal, GiftNifty is indicating a 60 to 70-point gap-up. With global markets remaining stable, we can expect a steady trading session today.

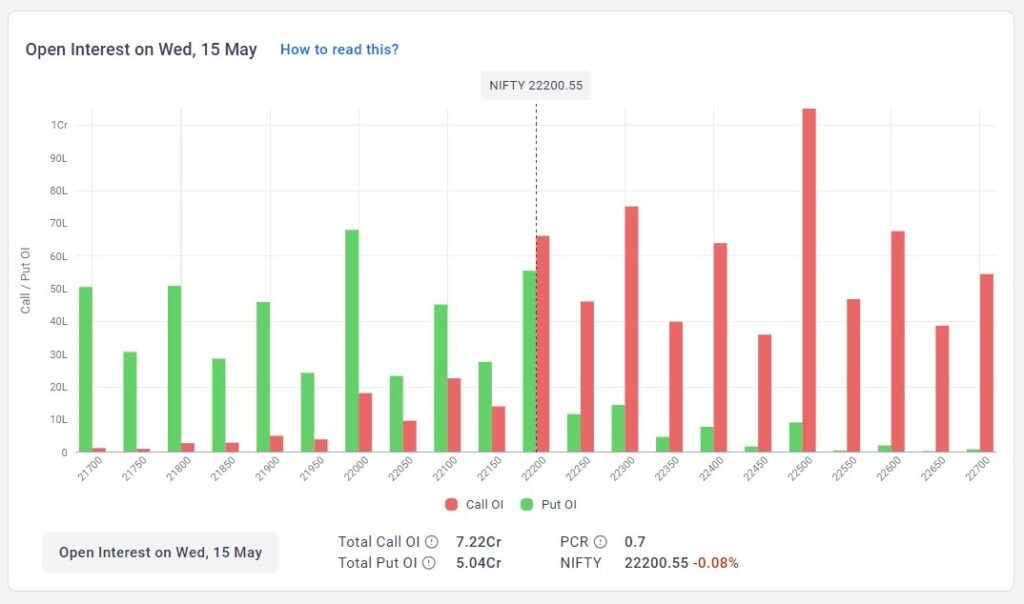

Nifty Outlook

Nifty closed at 22200, with May futures at 22287, reflecting a flat performance compared to the previous close. There is a significant Put Open Interest (OI) of 3.43 crore between 22000 and 21700, indicating strong support from Put writers at these levels. On the resistance side, Call writers hold 3.58 crore OI from 22200 to 22500. This suggests that the market might face resistance at these levels for the weekly series. Notably, Put writers have shifted their support from 22000 to 21700, signaling a potential test of lower levels around 21700 on today’s weekly expiry. This movement allows day traders to capitalize on a possible 300 to 400 point swing between the day’s high and low. Retail traders should focus on stock-specific opportunities in such a volatile environment.

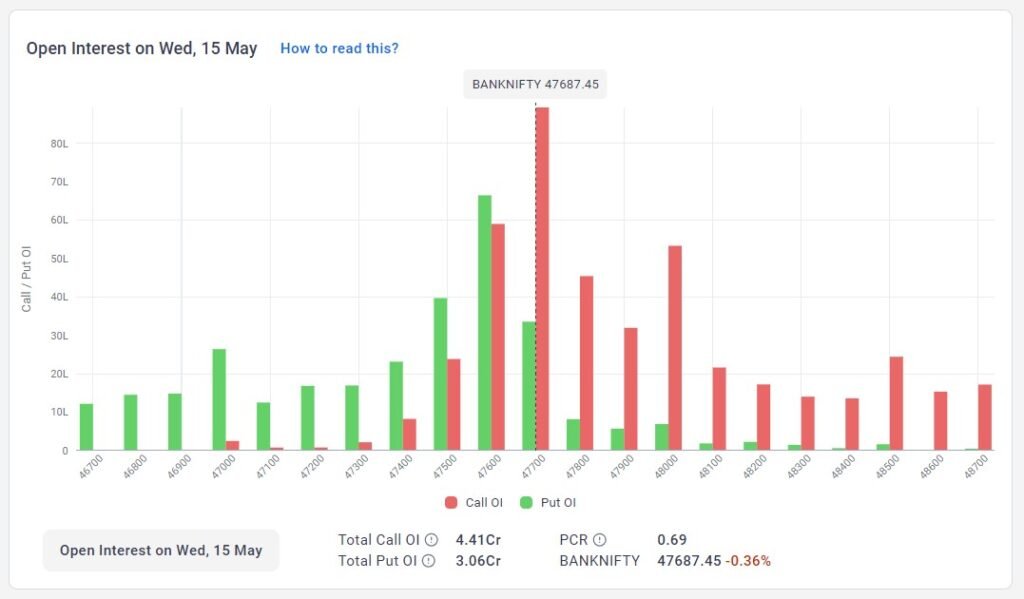

BankNifty Outlook

BankNifty had its weekly expiry yesterday, closing below 48000 at 47687, with May futures at 47908, indicating weakness in banking stocks. The market respected the Call Writers’ zone of 48000 to 48500, while Put Writers supported BankNifty at 47500. Today, Call writers are positioned between 47600 to 48000 with an OI of 2.79 crore, giving clear resistance at 47700 with the highest OI of 89.37 lakh. On the other hand, Put writers have moved their support base from 47600 to 47000 with an OI of 2 crore, indicating the strongest support at 47600. We can expect BankNifty to test lower levels of 47300 to 47000 today. It is highly unlikely that the market will break the strong resistance at 47700. However, if at any point the market breaks out above 47775, it might test upper levels up to 48000.

Summary of the Day

Today’s trading session is poised to be influenced by the expiry of Nifty, with indications pointing towards a stable opening and a potentially volatile day. Nifty’s substantial support at 22000 to 21700 and resistance between 22200 to 22500 suggest a range-bound movement with a possible test of lower levels around 21700. Similarly, BankNifty is expected to respect the Call Writers’ resistance between 47600 to 48000 and Put Writers’ support at 47000 to 47600. Traders should brace for opportunities within a 300 to 400-point range for Nifty and a 400 to 500-point range for BankNifty, keeping a close eye on breakout levels. Retail traders are advised to focus on stock-specific opportunities amidst the expected volatility.

Nifty Options Trading Range 16th May 2024

BankNifty Options Trading Range 16th May 2024

Options Range: 22000 to 22350

Options Range: 47000 to 48000

Leave a Reply

You must be logged in to post a comment.