Unlocking Market Potential: Nifty and BankNifty Strategies for a Volatile Expiry Day: May 15th, 2024

Market Overview

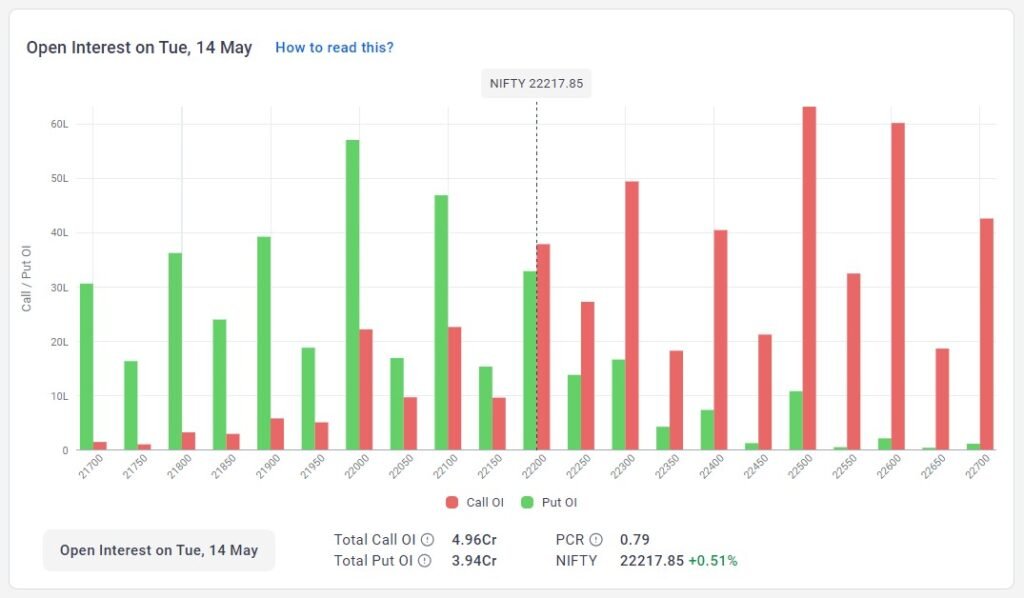

Today is Wednesday, which means it’s BankNifty expiry day. Yesterday, we witnessed a decent rally of 100 points in the market. As I had suggested, the 10:15 AM fifteen-minute candle closed above 22150, giving us a rally up to 22350. However, BankNifty remained range-bound between 47850 and 48200, supported by short covering in HDFC Bank. The market is expected to remain volatile today. At the time of writing, GiftNifty is up by 60 to 65 points, suggesting that Nifty will open at around 22300. This level is the first strong resistance zone for Call Writers, with significant call writing observed at 22400 and 22500. Considering tomorrow’s weekly expiry, it will be challenging for the market to break through this Call Writers’ zone.

Nifty Outlook

Nifty closed at 22217, with May futures at 22308, marking an increase of about 100 points from yesterday’s close. There is substantial Put Open Interest (OI) at 22000, 22100, and 22200, with 32.95L, 46.92L, and 57.1L respectively, confirming strong support from Put writers at these levels. On the resistance side, Call writers have built up significant OI at 22300, 22400, and 22500, with 49.46L, 40.51L, and 63.23L respectively. Given tomorrow’s weekly expiry, it is expected that the market will remain range-bound between 22200 and 22450. Therefore, it’s advisable not to chase the market at the gap up.

BankNifty Outlook

Yesterday’s staggering rally catapulted BankNifty to close at 47754, with May Futures soaring to 48003, a dazzling surge of 700+ points. As I’ve mentioned before, BankNifty roams within a 2000-point range, oscillating between 47000 and 49000. Today, with the market showing signs of a gap up, we may flirt with the lofty heights of 48500. However, should fate turn against us, brace for a dip to 47500 in the first half, followed by a spirited rally back to 48000, Tomorrow’s BankNifty Expiry adds an extra dash of spice, with hefty Call OI looming at the 48000 strike price, making it highly improbable for the market to close above this mark in this weekly contract. Traders, get ready for a rollercoaster ride, with opportunities abound on both ends, offering a tantalizing bounty of 300 to 500 points.

With today’s weekly expiry, BankNifty experienced a range-bound trading session yesterday, closing at 47859, with May futures at 48091. This clearly indicates that the market respects the Call Writers’ zone between 48000 and 48500. Meanwhile, Put writers at 47500 and 47000 will ensure that the market does not close below these levels. As a result, we can expect a range-bound market today amidst expiry-related volatility. This scenario provides good trading opportunities for both bulls and bears within a range of 400 to 500 points on both sides.

Summary of the Day

Today’s trading session is set to be influenced by the BankNifty expiry, with the market showing signs of volatility. Nifty’s strong support at 22000, 22100, and 22200, coupled with resistance at 22300, 22400, and 22500, suggests a range-bound movement between 22200 and 22450. Similarly, BankNifty is expected to stay within the Call Writers’ zone of 48000 to 48500, with Put Writers ensuring support at 47500 and 47000. Traders should brace for a dynamic trading environment, offering opportunities on both the bullish and bearish fronts within a 400 to 500-point range. As always, trade wisely and stay vigilant, especially with the weekly expiry approaching.

Nifty Options Trading Range 15th May 2024

BankNifty Options Trading Range 15th May 2024

Options Range: 22000 to 22350

Options Range: 47000 to 48000

Leave a Reply

You must be logged in to post a comment.