Navigating Market Trends: Insights for May 13th, 2024

Market Overview:

Last week, the markets saw a recovery from lows and successfully defended the 50 DMA (Daily Moving Average). Globally, markets are exhibiting a sideways trend, awaiting a trigger to determine their direction. Similarly, the Indian market is indicating a sideways movement until June 4th, when the Lok Sabha election results will be declared. Given this scenario, it’s advisable to trade cautiously with small quantities. Additionally, it’s better to avoid options trading and instead focus on identifying long-term investment opportunities in stocks.

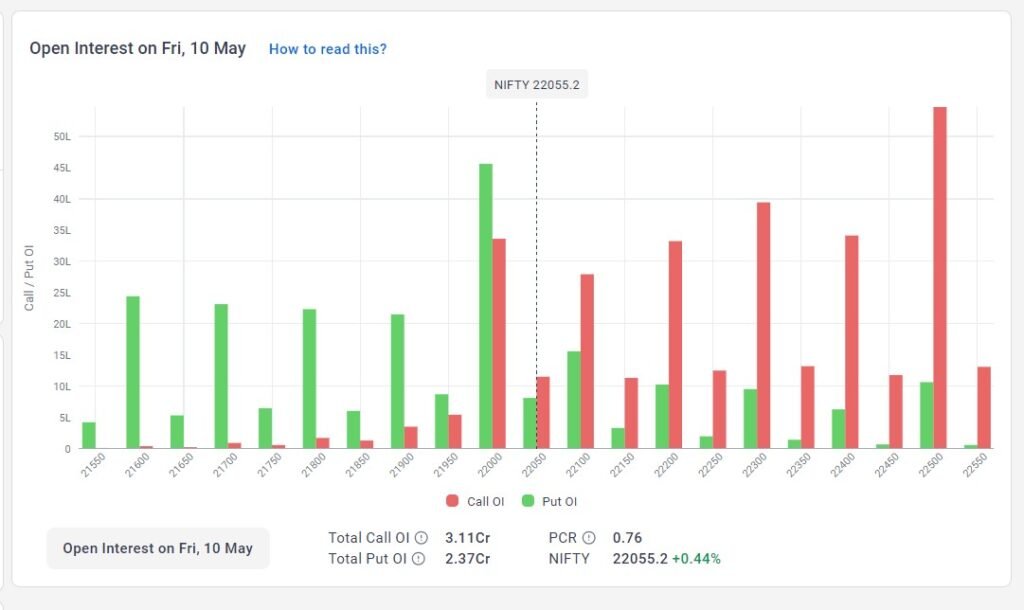

Nifty Outlook

Nifty closed at 22055, with May futures at 22140, surpassing the psychological level of 22000. Notably, there is a significant PUT Open Interest (OI) build-up at the 22K Monthly Contracts, indicating that the market is likely to defend this strike. Conversely, there is a CALL OI build-up at the 22500 Strike price, suggesting that the market will likely remain range-bound within these 300 points for this week’s closing. Today’s GiftNifty suggests a nearly flat opening of -30 to -40 points. Key trading levels for today are 22050 on the lower side and 22350 on the upper side. Breaching either level could result in a strong upward or downward movement in the market. It’s crucial to remain vigilant of open positions and advisable not to carry them until the Lok Sabha election results are announced.

BankNifty Outlook

BankNifty closed at 47421, with May Futures at 47607, placing it squarely in the middle of the option writers’ zone. There is notable Call OI at the 48000 strike, with first support at 47500 and a major support level at the 47000 strike price. This indicates that the market is likely to remain within the range of 47K to 48K. A breakout in either direction could lead to a significant upward or downward movement, presenting lucrative opportunities for day traders.

As we step into today’s trading session, it’s essential to keep these insights in mind and adapt our strategies accordingly. Stay tuned for further updates as the day progresses.

Nifty Options Trading Range 13th May 2024

BankNifty Options Trading Range 13th May 2024

Options Range: 22050 to 22350

Options Range: 47000 to 48000

Leave a Reply

You must be logged in to post a comment.